Contact our firm now:

A Guide to Calculating Child Support in Texas

Child support can be a difficult and complicated subject. Due to the sensitive nature of child custody and support cases, we go the extra mile to help parents do what’s right for their children. Our goal is to help our clients obtain a positive outcome. Our competent and experienced family law attorneys are here to help you through this trying time.

We are here to help you with your child custody case and walk you through the child support process when it comes to child support in Texas.

Texas Child Support, Medical Support, and Dental Support

In the state of Texas, it’s more common for noncustodial parent to make child support payments. They may also be required to provide medical and dental support as well. A noncustodial parent is a parent who was not granted the right to choose the child’s primary residence. This person can either be a possessory conservator, a joint managing conservator, or they may not even be a conservator.

In many cases, parents can work together to create their own agreed-upon arrangements for child support, medical support, dental support, and more. They’ll present their agreement to the judge, and, as long as the judge considers the agreement to be in the best interest of the child, they will approve it.

However, if your child has received Medicaid benefits or Temporary Assistance for Needy Families (TANF), then the office of the attorney general will also play a role.

Whether you agree as parents, or if you’re just trying to get an idea of what to expect when it comes to child support amounts, you’ll need a neutral party such as a law firm or a mediator. This party can also help you create a parenting plan that works for the involved parties. This should include the specifics of child custody and support including medical and dental support.

If you’re not sure where to start, you can also follow the state’s child support guidelines.

Child Support Calculator – Texas

Child support is intended to help the custodial parent pay for the expenses associated with raising a child. This includes expenses such as:

Food

Clothing

Housing

Child Care

The state of Texas the court could order either or even both parents to pay child support. However, more often than not, the non-custodial parent (the parent who spends the least amount of time with the child or children) is the one who pays the support. They are referred to as the obligor.

Payment is based on a percentage of the obligor’s income and the number of children. Texas law issues the guidelines regarding how much the noncustodial parent should pay for support. In most cases, the judge will follow these guidelines, but they can rule as they see fit if the circumstances permit. The formula used does not consider how much time you spend with the child or children, nor does it consider your type of conservatorship.

If you are a noncustodial parent, you can use the Texas child support calculator or follow the steps below to get an idea of what your support payments may be.

1. Calculate monthly net resources

Begin calculations with your yearly gross income. This means the money you receive in a year from the following:

- Alimony

- Compensation from your job

- Investment income

- Unemployment benefits

- Social Security disability payments

- Social Security retirement

- Net income from rental properties

- Any other form of income

Do not include your spouse’s income or resources, foster care payments, TANF benefits, or Supplemental Security Income (SSI).

It’s important to note that if you’ve made the choice not to work or if you choose to make as little money as possible, then the judge may decide to calculate your gross income based on working 40 hours per week at minimum wage.

You’ll then divide your yearly gross income by 12 to get the amount of your average monthly gross income. From there, subtract what you pay each month for:

- Federal income tax (using the rate for a single person)

- State income tax

- Social Security tax

- Union dues

- Medical Support

- Dental Support

This number now represents your monthly net income or net resources.

If your monthly net income exceeds $9,200 then the standard child support guidelines will not apply, and it is best to speak to a divorce attorney.

2. Determine the number of eligible children

Texas Family Code states that children qualify for support until they turn 18 years old, or they graduate from high school, whichever is later. Children who have disabilities may be considered to be eligible for a longer period; typically, until they either recover from the disability or until a specific date.

Children who are emancipated, marry, or join the military prior to turning 18 years old are not eligible.

You’ll want to count the number of qualifying children for the case in question, as well as any other qualifying children.

3. Determine the percentage of what you owe based on qualifying children

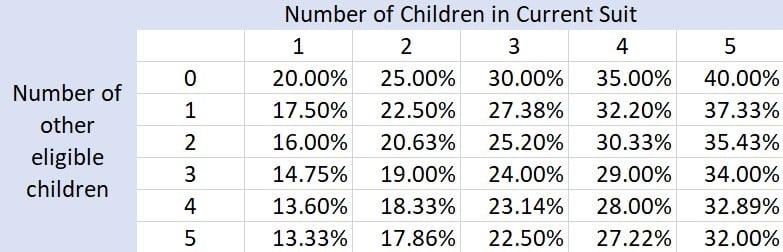

This chart shows what percentage of net income you will owe the custodial parent each month.

The top row signifies the number of children eligible for child support in your current court case. The left column embodies any other eligible children you may have. For example, if your current case is for two children and you have one other eligible child, the percentage would be 22.50%.

4. Multiply the percentage to your monthly net income

Take the percentage from the previous step and multiply it against your monthly net income from the first step. For example, if your monthly net income is $5,000 then you would multiply it by 22.50% to get $1,125 (5000 x 0.2250 = 1125).

In this example, you would need to pay $1,125 in child support each month to the custodial parent according to the guideline.

This monthly number is subject to change as each child becomes ineligible. You can then follow the steps again to understand your updated child support amount as your circumstances change. Speak with an attorney if you need to reduce the amount of your child support payments.

Child Support Payment Options

A child support order doesn’t have to be monthly. The judge can court order child support on an alternative schedule, as a lump sum, as a property transfer, or even as an annuity purchase. Also, if the non-custodial parent did not live with the child or help support them in the past, the judge may order retroactive child support, commonly known as back child support.

Child Support Enforcement

If a parent isn’t paying their court-ordered child support, then it’s a good idea to consult your lawyer for legal advice. Failing to comply with a child support order has serious consequences. These consequences include:

Interest charges

Fines

Jail time

Liens

Garnishment

License suspension

Community supervision

These are just some of the consequences. The state of Texas takes child support enforcement very seriously.

Unique Situations

There are some situations where it may be more difficult to determine the child support obligation. Some factors, such as 50/50 possession, make monthly child support calculations more challenging. In these instances, it’s best to reach out to an attorney.

An attorney will be able to walk you through both the custody and support side of things to help you and the other parent do what’s best to meet the needs of the child. They have the knowledge and experience to walk you through the process of determining physical custody agreements, any spousal maintenance, visitation, and anything else that you may not have even thought about.

At The Jimenez Law Firm, we understand the complexities of custody and support cases. Our office has the resources needed to get you through this difficult time. Please reach out to us online or call our offices at 214-513-0125 for more information.